Chuck Kirkpatrick and Steve Sohn

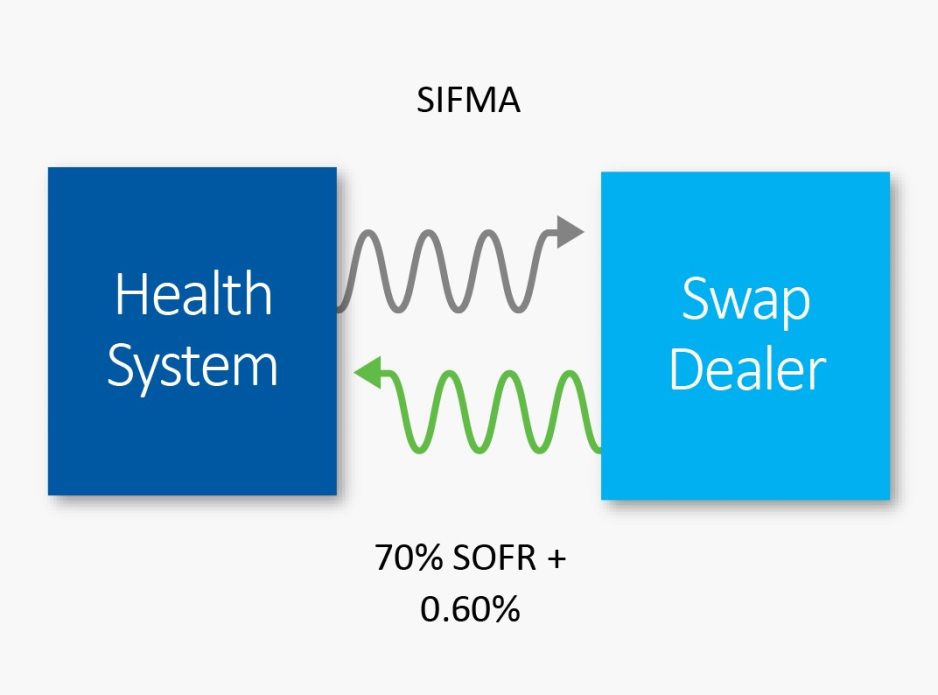

Basis swaps—essentially, the swap of one floating interest rate for another (Figure 1)—have been historically a valuable source of income for many of our healthcare borrowers. Borrowers are paid based on the notional trade amount multiplied by a spread plus or minus any basis mismatch between the variable rate legs. Basis swap pricing was most recently attractive in the spring and late fall of 2022, when monetary tightening by the Federal Open Market Committee drove up both short- and long-term interest rates.

Figure 1: A Basis Swap of Rates Tied to SIFMA and SOFR

Favorable execution levels for basis swaps often occur in illiquid markets. These opportunities can emerge quickly, and last for a short period of time. While there are no strong indications that we are on the verge of entering a new period of market illiquidity, the conditions that make a basis swap execution attractive can be precipitated by unexpected events. Health systems that have laid the groundwork for execution of a basis swap are positioned to promptly take advantage of what may be a short-lived opportunity.

Setting a basis swap execution target

The key to successfully executing a basis swap is to act when the market is stressed and pricing is at historically attractive levels. Given the time required to secure governance authorization, we recommend setting a pricing target for the swap and securing advance approval to execute if this target is reached. With credit approval and onboarding in place with a swap dealer (or dealers), the swap can be executed before the opportunity disappears.

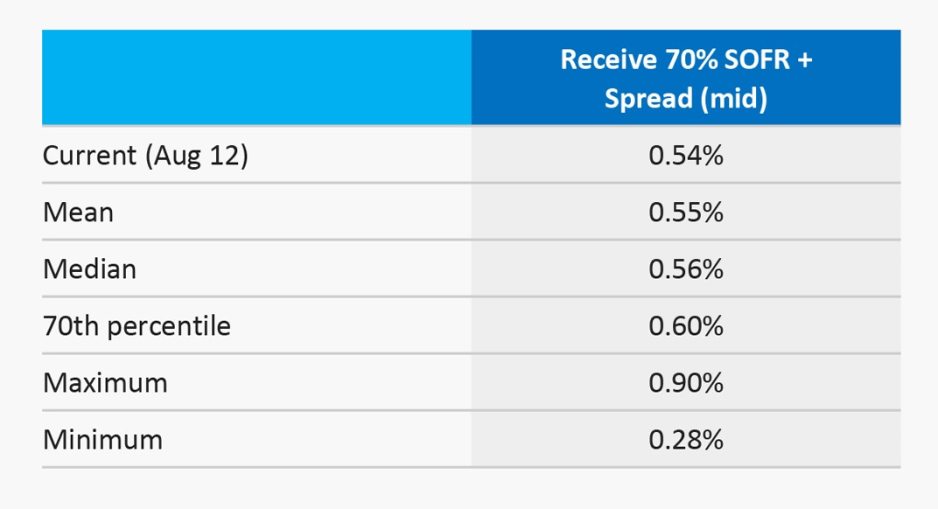

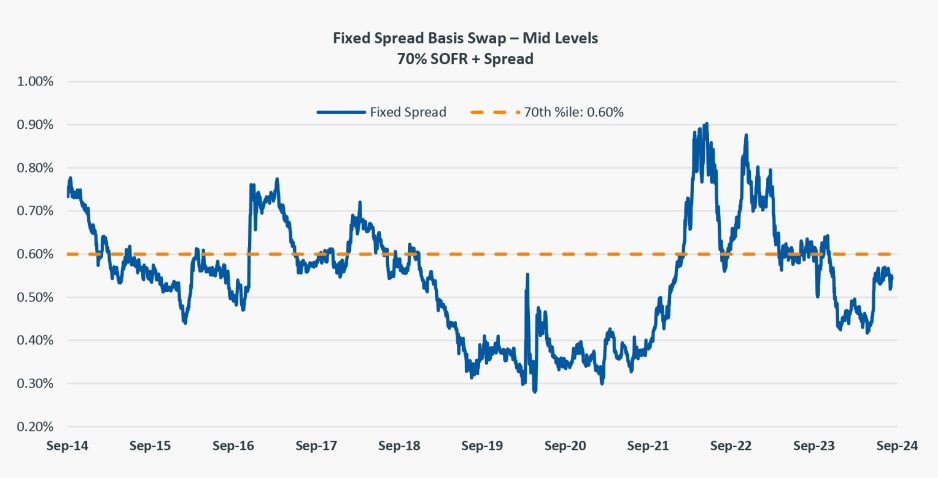

The goal is to set a target at a prudent level that health system leaders are comfortable with and that has a reasonable chance of being met in an illiquid market. This target can be identified based on empirical rate data. Figure 2 shows a table based on pricing observations over the past 10 years. At lower percentiles, pricing is less attractive. At higher percentiles, execution levels are more favorable. In this example, pricing at the 70th percentile—in which the health system enters into a 20-year basis swap where they receive a rate of 70% SOFR plus a 0.60% spread—has been identified as the target. Over the 10-year period, 70% of pricing observations have been less favorable, which suggests good conditions for entry (Figure 3).

Figure 2: Setting the Targeted Rate

Figure 3: Historically Observed Pricing Data for a 20-Year Basis Swap

Source: Bloomberg

Health systems do not have to commit to a single targeted rate; they can set multiple targets with associated notional amounts (for example, $50 million of notional at a 70% SOFR + 0.60% spread and another $50 million at a 70% SOFR + 0.65% spread).

Aligning the target with organizational needs

The ideal target will vary from organization to organization, based on available resources and risk appetite. Having these conversations in advance and setting a target (or targets) appropriate for your organization’s needs will help ensure the ability to execute a successful swap transaction when favorable pricing emerges.