At the surface, 2024 appeared to be a year of industry stabilization. Operating margins showed sustained improvement, and all three rating agencies issued stable or neutral outlooks for not-for-profit hospitals and health systems in 2025 (Moody’s Ratings adjusted its outlook from negative to stable at the end of 2023, and Fitch and S&P Global Ratings made similar adjustments at the end of 2024).

It was not necessary to dig too deeply, however, to find signs of ongoing distress below the surface. The title of S&P’s 2025 outlook noted that the industry was “stable but shaky for many amid uneven recovery.”[1] Moody’s reported that although the industry outlook is stable, with a median operating cash flow margin approaching 7%, “the pace of margin improvement is slowing, and not all hospitals have reached this level of profitability.”[2] Fitch described an ongoing trend of what it describes as a “trifurcation” in credit quality, with a small percentage of rated organizations doing well, the largest percentage showing mixed results, and the remaining portion continuing to struggle.[3]

The numbers from hospital and health system M&A activity in 2024 confirm the unevenness of recovery and the challenges that many organizations continue to face:

- The percentage of 2024 announced transactions involving a financially distressed party hit a record high.[4]

- Forty-five of the 72 announced transactions in 2024 (62.5%) involved a divestiture (i.e., a health system or governmental entity selling off a portion of its assets), the highest percentage the industry has experienced and more than double the percentage recorded in 2023.

- The percentage of announced transactions in which the smaller party had a credit rating of A- or higher plunged, reaching an all-time low.

2024 also saw the emergence of new partnership models, with General Catalyst’s Health Assurance Transformation Corp. (HATCo) subsidiary announcing its planned acquisition of Ohio-based Summa Health early in 2024, and Risant Health, a new company launched by Kaiser Permanente in 2023, completing the acquisition of its second member, North Carolina-based Cone Health.

The Year in Numbers

- In 2023, we reported what was then a record-breaking percentage (27.7%) of the number of announced transactions involving a financially distressed party. That figure was topped in 2024, with 30.6% of announced transactions involving a financially distressed party (Figure 3).

- Equally noteworthy was the growth in size of the seller in financially distressed announced transactions, averaging $401 million in annual revenue in 2024 (Figure 4). This is almost double the next largest figure from 2022 ($219 million) and generated $8.8 billion in total transacted revenue for financially distressed announced transactions in 2024 (in comparison, total transacted revenue for financially distressed announced transactions in 2023—when the percentage of financially distressed transactions reached 28%—was $2.3 billion). Together, these figures suggest that the days when financial distress was largely concentrated among smaller critical access or community hospitals may be behind us.

- In most years, approximately 30% - 40% of announced transactions involve a divestiture; in 2023, for example, that percentage was 31.1%. The percentage skyrocketed in 2024, reaching 62.5% and breaking the recent record of 56.2% seen in 2020 (Figure 5).

- From 2020 – 2023, we saw sustained growth in the percentage of announced transactions in which the smaller party had a credit rating of A- or higher. In last year’s report, we noted that this level was sustained despite what was then a record-breaking number of announced transactions with a financially distressed party. As financially distressed transactions grew again in 2024, the percentage of announced transactions with a smaller party credit rating of A- or higher plunged from 12.3% in 2023 to 2.8% in 2024 (Figure 6).

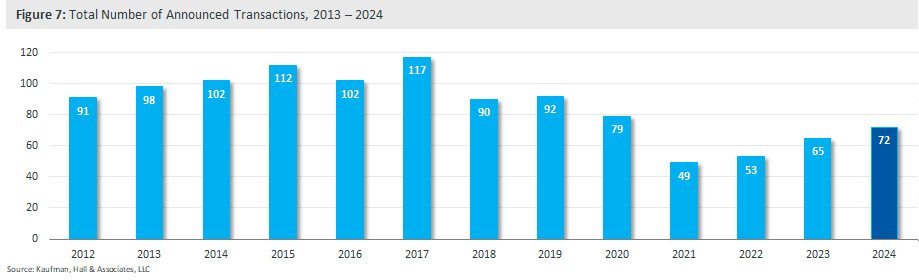

- The total number of announced transactions in 2024 (72) continued its growth upward from the recent low point of 49 announced transactions amid the Covid pandemic in 2021 (Figure 7).

- The average size of the smaller party by annual revenue in 2024 remained high at $559 million, below 2022’s historic high of $852 million but comparable to the levels recorded in 2021 and 2023 (Figure 8).

- Total transacted revenue also remained high by historical standards, at just below $40 billion (Figure 9).

M&A Trends 2024

In 2024, we saw the continuation—and intensification—of two trends called out in our 2023 year-end report. First, the percentage of financially distressed organizations seeking a partner continued to grow. The new twist in 2024 was that these organizations were significantly larger in size than in earlier years. Second, we saw the ongoing reorganization of regional markets, marked by a record high percentage of transactions involving a divestiture.

New this year, and consistent with the continuing story of financial distress, was a significant decline in the percentage of announced transactions in which the smaller party had a credit rating of A- or above. And while perhaps not yet a trend, 2024 also saw organizations making bold moves to transform health system operations and care delivery through new partnership models.

Financial Distress

The record high percentage of announced transactions involving financially distressed parties speaks to the ongoing challenges many hospitals and health systems face as they struggle to recover in the new post-pandemic environment, in which revenue growth has been matched, and at times outpaced, by expense growth. Median figures in the most recent Kaufman Hall National Hospital Flash Report show that while net operating revenue per calendar day was up 20% over 2021 through October 2024, total expense per calendar was also up 19%. As these are medians, roughly half of hospitals and health systems were below this performance level.

Our 2023 year-end report also noted a trend that exploded in 2024: While many financially distressed organizations have been smaller hospitals and health systems, the addition of larger systems to the mix has resulted in significant growth in the average size of a financially distressed partner by annual revenue. High-water marks for this figure hit $175 million in 2020 and $219 million in 2022. This year, the average size of a financially distressed partner reached $401 million.

The growth in the size of financially distressed parties is mirrored by another trend we think is beginning to emerge. In past years, mega merger transactions (those in which the smaller party has annual revenues in excess of $1 billion) were largely between two organizations of similar size (e.g., a $1 billion system merging with a $2 billion system). We are starting to see mega merger transactions in which the smaller party is now merging with a party of significantly greater size. Examples from 2024 include:

- Nuvance Health’s planned merger with Northwell Health

- Summa Health’s planned acquisition by HATCo

- Cone Health’s acquisition by Risant Health

- Marshfield Clinic Health System’s merger with Sanford Health

While these may not qualify as financially distressed transactions, they do suggest that financial and operational challenges are moving up the scale, prompting larger organizations to seek a partner. This is a trend we will continue to monitor in 2025.

Divestitures and Market Reorganization

Last year’s report also highlighted the reorganization of regional health markets, as large, multi-market for-profit and not-for-profit health systems engaged in portfolio realignment, divesting from non-core markets to focus their resources on core markets with good growth potential where scarce resources could best be deployed.

Market reorganization activity increased markedly in 2024, including a record 62.5% of announced transactions. The bankruptcy of Steward Health Care contributed to this increase (see sidebar), but even without the Steward transactions, divestiture activity persisted throughout 2024.

As market reorganization continues, these divestitures enable the opportunistic acquisition of assets by regional health systems seeking to build and deliver expanded and more coordinated care across a combined system.

Sidebar: The Impact of Steward Health Care’s Bankruptcy

Steward Health Care’s bankruptcy was a factor in both the heightened percentage of financially distressed transactions announced in 2024 and the increased percentage of announced divestiture transactions. Regardless of the Steward transactions, these trends continued from 2023 into 2024, but we may not have seen the record-breaking percentages that show up in the numbers.

One other metric that may have been affected by the Steward transactions is the dramatic growth in the size of financially distressed parties in announced 2024 transactions. It is noteworthy, however, that only one of the Steward transactions (the sale of Steward hospitals in Florida, Louisiana, and Texas to Healthcare Systems of America[5]) qualified as a mega merger.

Credit Ratings

Credit ratings caught up with the growing percentage of financially distressed transactions announced in 2024, as the percentage of announced transactions in which the smaller party had a credit rating of A- or above dropped from 12.3% in 2023 to 2.8% in 2024. This is a metric we have historically tracked to establish the extent to which organizations with strong credit ratings are seeking partners.

The drop in this percentage may simply reflect a broader reset in credit ratings, driven by the adverse operational and financial headwinds hospitals have faced in recent years. The pace of rating agency credit downgrades vs. upgrades, while beginning to slow down, is still elevated. S&P Global Ratings had a downgrade-to-upgrade ratio of 3.7 to 1 as of October 31, 2024, compared to a ratio of 4.4 to 1 as of the same date in 2023.[6] Rating agency industry outlooks have returned to stable or neutral, but some organizations have gone down a notch in their credit rating. A similar reset is seen in the 2024 announced transactions figures. While only 2.8% now have an A- or higher rating, 11.1% of 2024 transactions were at the BBB level.

At the same time, we are seeing significant buy-side activity from higher-rated organizations as they seek growth opportunities. Examples from 2024 include:

- Duke Health’s planned acquisition of Lake Norman Regional Medical Center in North Carolina

- HonorHealth’s acquisition of Steward Health Care facilities in Arizona

- Prisma Health’s acquisition of Blount Memorial Hospital in Tennessee

- Vitruvian Health’s[7] acquisition of Tennova Healthcare – Cleveland in Tennessee

These transactions are also representative of the regional market reorganization trend commented on above.

Transformative New Partnership Models

Two transactions announced in 2024 represent bold bids for transformative change. In January, General Catalyst’s HATCo subsidiary announced its planned acquisition of Ohio-based Summa Health. The transaction is expected to close early in 2025 subject to final regulatory approvals. When HATCo was formed in 2023, it announced its intention “to acquire and operate a health system for the long term where we can demonstrate the blueprint of…transformation for the rest of the industry.”[8] Its planned acquisition of Summa will provide that opportunity.

The second transaction was a continuation of a lead story from 2023: Kaiser Permanente’s formation of Risant Health. Risant announced the acquisition of its first member, Geisinger Health, in 2023, and in 2024, announced and closed on the acquisition of its second member, North Carolina-based Cone Health. Risant’s goal is to transform the healthcare system by bringing together “like-minded organizations to accelerate value-based approaches and transform how care is delivered for patients and communities.” As the number of health systems participating on the platform grows, Risant will draw on its members’ expertise to “advance value-based care by sharing best practices, evidence-based care approaches, and tools to deliver quality outcomes.”[9]

In many ways, the numbers from 2024 reflect an industry in need of change. HATCo’s and Risant’s progress will be closely watched, and we anticipate more transformative efforts to emerge in the years ahead.

Looking Forward

Looking forward to 2025, we anticipate:

- Possible change in the regulatory environment. The federal antitrust enforcement agencies took an aggressive stance in challenging healthcare mergers under the Biden administration. That may change, although the first Trump administration also demonstrated heightened scrutiny of M&A activity.

- Continued portfolio and market realignment. While industry performance has stabilized, many organizations face ongoing financial pressures and scarce resources. This will drive continued divestitures, but also new partnerships—including joint ventures with partners in key verticals such as behavioral health, imaging, senior living, and labs—that can expand services with a lower capital commitment.

- Changes in leadership driving organizational change. A growing number of executive team member retirements are prompting organizations to consider partnership opportunities, whether to fill gaps in leadership or to take the health system in a new direction under a different leadership team.

- A search beyond safety in scale. Transactions that seek scale for scale’s sake have been replaced by a focus on strategic transactions that add new capabilities or provide access to new markets. Nonetheless, we increasingly see relatively large systems seeking partnerships with even larger organizations, a sign that industry pressures are expanding their range.

- Further efforts for transformative change. There are serious questions about the long-term sustainability of the current healthcare system. Change will likely have to come from within the industry and we are seeing those efforts emerge.

Select Transactions Announced or Closed in 2024 in Which Kaufman Hall Served as an Advisor

Co-authors:

Kris Blohm, Managing Director and Mergers & Acquisitions Practice Co-Leader, kblohm@kaufmanhall.com

Courtney Midanek, Managing Director and Mergers & Acquisitions Practice Co-Leader, cmidanek@kaufmanhall.com

Anu Singh, Managing Director, asingh@kaufmanhall.com

Chris Peltola, Senior Vice President, cpeltola@kaufmanhall.com

Rob Gialessas, Vice President, rgialessas@kaufmanhall.com

Additional contributors:

Nick Bidwell, Managing Director, nbidwell@kaufmanhall.com

Nick Gialessas, Managing Director, ngialessas@kaufmanhall.com

Nora Kelly, Managing Director, nkelly@kaufmanhall.com

Eb LeMaster, Managing Director, elemaster@kaufmanhall.com

For media inquiries, please contact Haydn Bush at hbush@kaufmanhall.com.

For the full PDF of this report please email info@kaufmanhall.com.

[1] S&P Global Ratings, “U.S. Not-for-Profit Acute Health Care 2025 Outlook: Stable but Shaky for Many Amid Uneven Recovery and Regulatory Challenges,” Dec. 4, 2024.

[2] Moody’s Ratings, “2025 Outlook: Stable as Profitability Rises Modestly on Revenue Growth, Cost Control,’ Nov. 13, 2024.

[3] Fitch Ratings, “U.S. Not-for-Profit Hospitals and Health Systems Outlook 2025: Margins Rebound Following the Deep Trough in 2022 – 2024,” Dec. 9, 2024.

[4] Financially distressed transactions are those in which a party has cited, or publicly available information has enabled us to infer, an element of financial distress as a transaction driver.

[5] Madeline Ashley, “Judge OKs Sale of 7 Steward Hospitals to American Healthcare Systems Affiliate,”Becker’s Hospital Review, Oct. 25, 2024.

[6] S&P Global Ratings, “U.S. Not-for-Profit Acute Health Care 2025 Outlook.” Despite the heightened ratio of downgrades to upgrades, credit rating affirmations still represent the bulk of rating agency actions.

[7] Vitruvian Health was formerly known as Hamilton Health Care System.

[8] General Catalyst, “Our Acquisition of Summa Health: Coming Together to Transform Healthcare.” Press release, Jan. 17, 2024.

[9] Risant Health, “Who We Are.” Website, accessed Jan. 5, 2025: https://risanthealth.org/who-we-are