As the delivery of care continues to shift from hospitals to community-based care sites and organizations make significant investments in their physician enterprise, we are increasingly observing widespread variation in utilization, payer mix, revenue and cost structure across service lines and care delivery platforms. In this environment, successful organizations must be able to define the profitability of their service lines and leverage that information at the enterprise level.

Service line strategic planning—which we are observing organizations use for services including oncology, cardiology, neurology, and women’s health, just to name a few—is often intended to support efforts to spur organizational growth and competitive positioning. Ultimately, health system leaders, in concert with service line leads, use these planning efforts to inform the development of new capital plans, provider recruitment efforts, and growth strategies.

However, we have also observed that organizations who conduct strategic planning efforts at the service line level don’t always employ current best practices for integrated strategic financial planning , which can lead to a lack of understanding of the plan’s financial ramifications.

We advise that organizations apply the same rigor to service line planning that they would for their overall financial plan. This includes:

- Understanding current state comprehensive service line profitability (including providers, partnerships, etc.)

- Comparing current state profitability to benchmarks

- Developing financial projections informed by the service line strategic plan (e.g., growth trajectory, provider recruitment, capital needs, etc.)

- Conducting sensitivity and scenario analyses to evaluate key strategic decisions

Hospitals and health systems are currently confronting a range of financial headwinds, ranging from intense competition in non-acute care settings to a difficult operating and financial environment to constrained resources for capital projects.

An integrated strategic and financial plan approach can lead to more informed decision-making on critical areas including provider investments, capital allocation, and portfolio decisions for growing, divesting, or partnering to develop the needed capabilities to compete moving forward.

Integrated service line planning can help organizations determine how to allocate resources for enterprise-wide activities. For instance, information gleaned during these efforts might also inform decisions about whether procedures like knee replacements are delivered in inpatient or ambulatory settings, how to potentially consolidate high-acuity inpatient services, or where to prioritize physician recruitment throughout the system to drive return on investment.

Getting Started: A Step-By-Step Approach

As organizations continue to shift to a service line model, leveraging the principles of integrated strategic financial planning will be increasingly critical. We recommend a process structured around the following steps:

- Analyze and quantify the comprehensive profitability of service lines, leveraging existing cost accounting techniques while ensuring all elements of the service line are accounted for

- Identify and prioritize the service lines driving the organization’s strategic direction

- Develop a service line level integrated strategic financial plan

- Integrate the updated measurement of service line profitability with existing cost accounting system methodology and data and ensure that all users can access profitability reports

Case Study

Kaufman Hall helped one large regional academic health system—working with C-Suite and clinical service line leaders—to develop a comprehensive view of their oncology service line’s profitability.

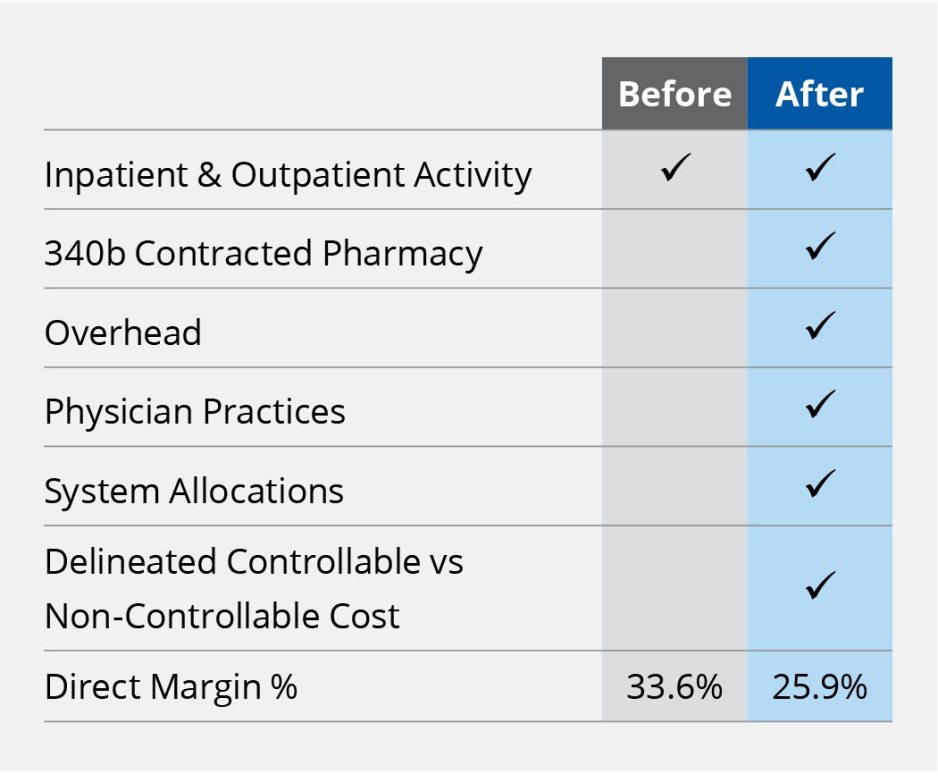

During the effort, leaders wanted to ensure all activities within the service line were accurately accounted for and attributed to the service line. Ultimately, the organization updated its existing profitability reports with enhanced, reliable profitability data (Fig. 1), with buy-in from clinical, operational, financial, and data analytics leadership.

The organization was then able to stress test the impact of potential initiatives, including further growth and investments, physician recruitment, and performance improvement and optimization efforts.

Figure 1: Oncology Service Line Profit & Loss Report (P&L)

Closing Thoughts

We are currently observing that some organizations are beginning to assess their financial opportunities and challenges across service lines and may even employ a service line leader to guide those efforts. However, few organizations currently possess the strategic financial planning rigor at the service line level that we believe is necessary for sustained success in an evolving and uncertain industry landscape.

Regardless of current capabilities, every health system can adopt the principles of integrated strategic financial planning at the service line level, improve their strategic decision making and capital allocation process, and leverage the insights to align with enterprise-wide planning.