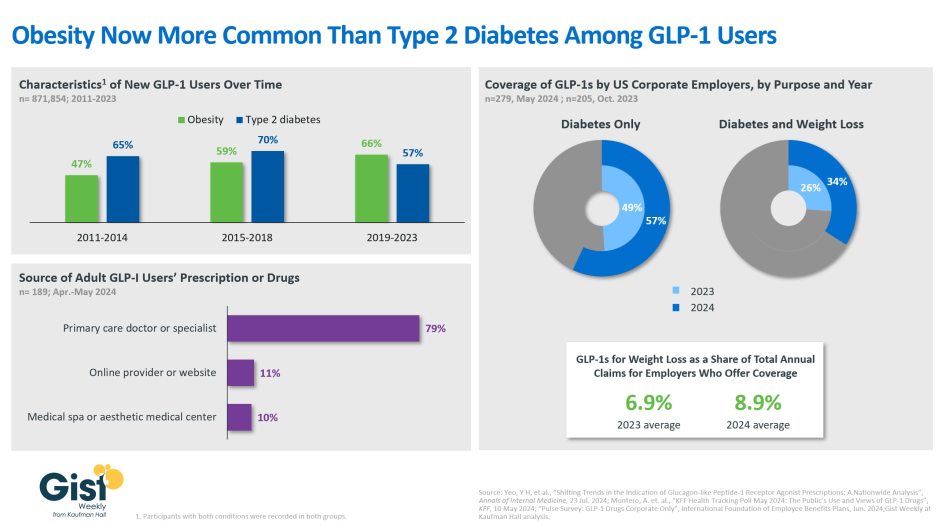

In this week’s graphic, we take stock of both the evolving usage and employer coverage of GLP-1 drugs, specifically for weight loss. Data from a new Annals of Internal Medicine study finds that more new US GLP-1 prescriptions were written for people with obesity than those with type 2 diabetes in recent years. Overall, the use of GLP-1 drugs among non-diabetic patients with either a BMI of 30-plus, or a BMI of 27 to 30 with an obesity-related co-morbidity, has doubled between 2011 and 2023. The persistent shortages brought on by these drugs’ expanding list of indications (semaglutide was approved for chronic weight management in 2021 and for cardiovascular risk in 2024; tirzepatide was approved for chronic weight management in 2023) is both exacerbating shortages for people with type 2 diabetes and driving many patients seeking them to non-traditional avenues. A recent KFF survey finds that more than a fifth of the 12% of US adults who report having ever used GLP-1s obtained their prescription or drugs from either an online provider or a medical spa, where the pitch is often focused on accessing expensive, difficult-to-find weight loss drugs for a fraction of their high prices. The drugs provided via these avenues are mostly compounded versions of GLP-1s, which are less regulated and may be unsafe. But employers’ willingness to cover name-brand GLP-1 drugs has also been increasing: a majority now cover them for diabetes only, and more than a third for both diabetes and weight loss. Employees and their beneficiaries with access to GLP-1 coverage for weight loss seem to be availing themselves of this benefit as employers offering it say that it represents an average of nearly 9% of their total annual claims. With more than a third of American adults considered to have obesity, and another third considered to be overweight, the demand for GLP-1 drugs for weight loss is only slated to increase.