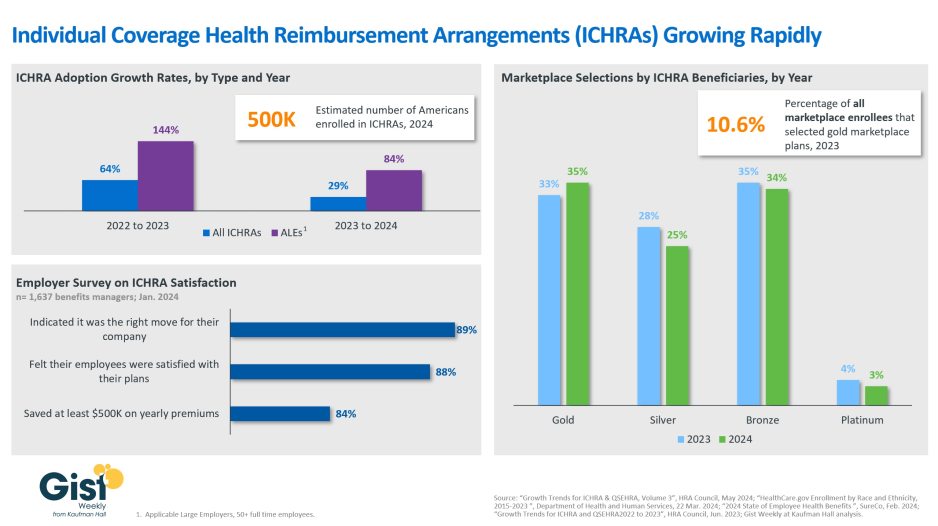

This week’s graphic dives into how individual coverage health reimbursement arrangements (ICHRAs), a relatively new coverage option, are being received in the market. Launched in 2020, ICHRAs allow employers to offer tax-exempt funds to their employees, rather than sponsoring their insurance plans more directly. Employees can use this benefit to pay for their own marketplace coverage or out-of-pocket healthcare costs. Although still only a small segment of the market, ICHRA adoption grew 29% from 2023 to 2024. Amid ever-increasing employer-sponsored insurance (ESI) costs, small and large employers alike may see ICHRAs as a more sustainable solution, granting employees more say in their care at potentially lower costs. Employers who have adopted this model so far appear to be happy about their decision, with many reporting high rates of satisfaction from their employees as well as reductions in annual premium expenses. On top of bringing more young people into the exchanges, many ICHRA beneficiaries select high-quality plans. In 2023, one-third of ICHRA beneficiaries selected gold marketplace plans compared to just under 11% of all marketplace enrollees. While further ICHRA growth could threaten providers’ payer mix, given that ESI reimbursement rates are often higher than marketplace rates, they also present a unique opportunity. ICHRAs’ increasing popularity shows that employers want an alternative to traditional ESI models and presents a strong case for health systems to bolster their direct-to-employer model investments.