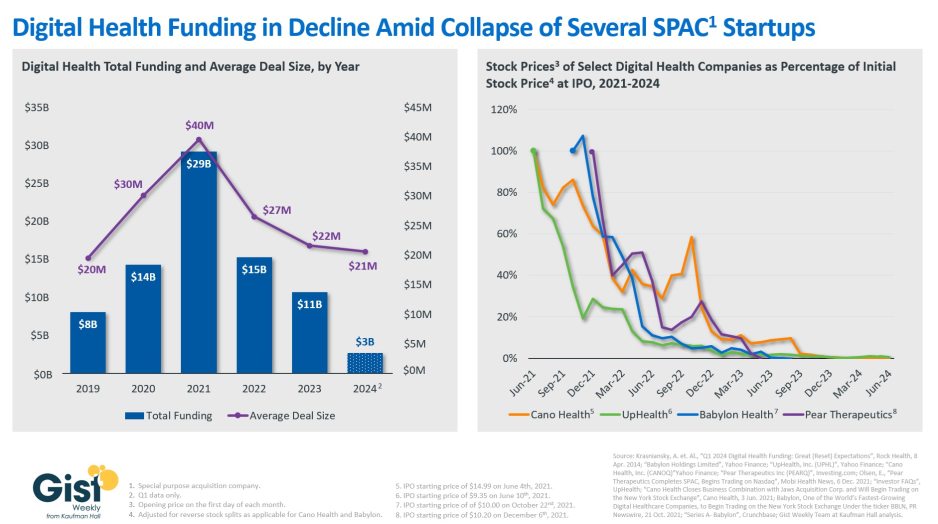

In this week’s graphic, we take stock of digital health funding and the fate of several digital health startups that went public during the funding boom of 2021. Digital health funding dropped to $10.7B in 2023, a 63 percent decline compared to 2021. Based on preliminary data from the first quarter of 2024, this year’s total is shaping up to be comparable to 2023 levels. The average deal size has also fallen to $21M, similar to pre-pandemic levels and only about half of its 2021 peak. Along with higher interest rates and a less bullish economy overall, the stock delistings and bankruptcies of several publicly traded digital health companies may also be impacting how investors consider the market. Several digital health startups that went public in 2021 via special purpose acquisition companies (SPACs), including Cano Health and Babylon Health, filed for bankruptcy only a few years later. Once touted as disruptors, these companies were unable to translate their initial capital infusions into sustainable operations. Already potentially overvalued by the economic environment at the time they went public, when they proved unable to return profits fast enough, investors lost faith, and the bubble burst. Given that most startups fail, and healthcare is particularly difficult to disrupt, the digital health market shouldn’t be written off entirely, but a reset in expectations (and valuations) is being established.