Welcome back to our analysis of the biggest healthcare news stories of the week. Please feel free to forward the Gist Weekly to friends and colleagues, and encourage them to subscribe as well.

In the News

What happened in healthcare recently—and what we think about it.

- Jefferson, Lehigh Valley proceeding with merger. On Wednesday, Philadelphia, PA-based Jefferson Health and Allentown, PA-based Lehigh Valley Health Network (LVHN) announced they signed a definitive merger agreement, after signing a non-binding letter of intent last December. The unified $15B system will operate 30 hospitals and more than 700 care sites across Pennsylvania and New Jersey. Jefferson CEO Joseph Cacchione, MD will serve as the CEO of the combined enterprise, and LVHN CEO Brian Nester, MD will assume the role of COO for the system and president of LVHN legacy operations. The deal is expected to close this summer, pending state regulatory review, as Dr. Cacchione previously indicated the Federal Trade Commission (FTC) is allowing the merger to proceed.

- The Gist: With this deal, Jefferson continues its recent growth, having finalized its acquisition of Philadelphia-based Einstein Healthcare Network in 2021, following a lengthy battle with the FTC. Dr. Cacchione has shared that the Jefferson-LVHN merger initially began with talks between the two systems about a plan to white label Jefferson’s government-focused health plan in Lehigh Valley’s market before the conversation broadened in scope to a full integration. Jefferson executives say the expansion of the academic system into a new market aligns with its strategic vision to increase resiliency and “double down” on its insurance business—strategies in line with health systems seeking “capability-based scale.”

- Ascension hit by a ransomware attack. Last weekend, St. Louis, MO-based Ascension, one of the nation’s largest not-for-profit health systems with 140 hospitals across 19 states and Washington, DC, confirmed that the cybersecurity incident it detected on May 8th was a ransomware attack. Ascension’s electronic health record system and MyChart system have been offline, and the system has had to pause some elective care and divert ambulances from several hospitals. Ascension has notified law enforcement and government agencies of the breach and engaged a cybersecurity company to assist with the investigation. The system has not provided an estimated timeline for service restoration as of its latest public update on May 15th.

- The Gist: Although this cyberattack is garnering national headlines due to Ascension’s size—and therefore the scale of the resulting disruption—Ascension is hardly the only health system that has been impacted by a hack recently. Cybersecurity incidents have significantly increased in both frequency and scale in recent years, with 360 provider organizations falling victim to hacking or IT incidents in 2023, exposing 43M patient records. The Health Information Sharing and Analysis Center, as well as the American Hospital Association, issued warnings just days after the Ascension attack about increased threats to the healthcare sector from the Russia-linked ransomware group Black Basta.

- Federal judge dismisses private equity firm from antitrust suit. On Tuesday, a US district court judge dismissed private equity (PE) firm Welsh, Carson, Anderson & Stowe as a defendant in the Federal Trade Commission (FTC)’s antitrust lawsuit against both it and US Anesthesia Partners (USAP). Last year, the FTC sued both USAP and its creator-turned-minority-owner Welsh Carson, alleging that they worked together to roll up smaller anesthesiology practices into an illegal monopoly and negotiated a price-setting scheme with independent anesthesia groups across Texas. The suit was the first of its kind to include the PE backer of a physician group platform company in antitrust litigation, but Judge Kenneth Hoyt dismissed Welsh Carson as a defendant on the grounds that the PE firm is only a minority owner in USAP and that the FTC failed to demonstrate how “receiving profits from an entity that may be violating antitrust laws is itself a violation of antitrust laws." The FTC’s case against USAP alone is still proceeding.

- The Gist: As part of its broader effort to regulate anticompetitive behavior in healthcare, the Biden administration took a swing by including Welsh Carson in this suit. Although the FTC failed in this attempt to hold a PE firm liable for the actions of one of its portfolio companies, the agency is likely to continue this pursuit in different ways, and Judge Hoyt’s opinion hinted at other approaches it could take for future cases. Meanwhile, the results of the ongoing suit against USAP still present major ramifications for the PE-backed provider group platform companies that exist across many physician specialties.

Plus—what we’ve been reading.

- Shared decision making in the internet age. Published recently in the Atlantic, this piece delves into how provider-patient interactions are being affected by a recent increase in patient-driven research, especially in pregnancy care. Some patients now expect to have a much more active role in charting the course of their care as they feel that their “Google search makes [them] an expert in medicine.” Shared decision making in medicine is not new, but the dynamic for providers has changed as patients have more information than ever, but not always from high-quality or trustworthy sources. The article suggests ways that providers and patients can work together to balance providers’ medical expertise with patients’ expertise of themselves.

- The Gist: Although this article has a particular focus on patient-provider interactions in obstetrics, shared decision making, when leveraged effectively and appropriately, can improve care across specialties. Patients are far more likely to adhere to a care plan if they better understand their condition and feel like an active participant. However, short appointment times create an unavoidable barrier to some patients’ desired level of engagement with their providers, leaving providers with the continued challenge of balancing both the science and humanity of medicine.

Graphic of the Week

A key insight illustrated in infographic form.

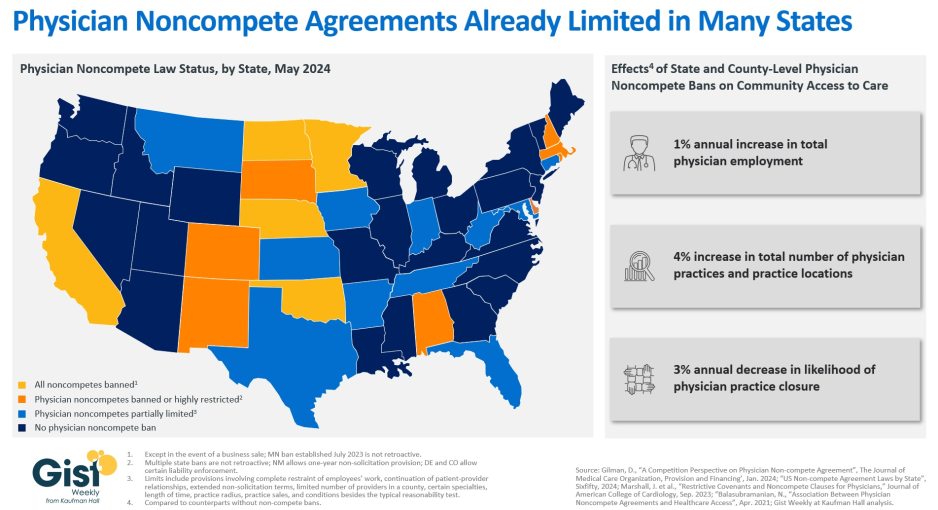

The state of state physician noncompete bans

With the Federal Trade Commission (FTC) issuing a final rule last month that bans noncompete agreements nationwide, the graphic below is our attempt to categorize the current status of complex state noncompete laws that affect physicians. Except in the event of a business sale, five states—California, North Dakota, Minnesota, Nebraska, and Oklahoma—ban all noncompete agreements for all employees, and at least 19 states either ban them for physicians or place varying limits on them for physicians. Examples of these limits include a narrow law in Florida that allows noncompetes to be voided if there is only one employer of a physician specialty in a county, and a Tennessee law that only permits physician noncompetes that bar a physician from practicing at facilities where their former employer provides services. As a noncompete agreement can restrict a physician’s ability to practice near a former employer for years,bans on physician noncompete agreements have been shown to improve community access to care. One study found that, compared to places that allow them, places that banned noncompetes for physicians saw increased physician employment, the opening of more physician practices, and a lower likelihood of practice closures. Should the new FTC ban survive the mounting legal challenges it faces, its effect on the physician labor market may be limited, as not-for-profit organizations fall outside the FTC’s traditional enforcement jurisdiction. However, the agency has indicated a willingness to reevaluate an entity’s not-for-profit status and stated that “some portion” of tax-exempt hospitals could fall under the final rule’s purview.

On the Road

What we learned from our work in the real world. This week from Bonnie Proulx, Senior Vice President, at Kaufman Hall.

Leveraging advanced practice providers (APPs) effectively

“We’ve really beefed up our APP ranks over the past few years,” a health system CMO recently told me. “That was the easiest way for us to meet returning demand across the system. But I’m not confident that all parts of our system are leveraging them how we should be.”

Based on employment projections, advanced practice providers (APPs) are a rapidly increasing presence within the clinical workforce, but their utilization varies significantly, not just across, but also within, health systems. I assured this CMO that her system’s ambulatory APP strategy appeared strong: more than half of their primary care FTEs were APPs, which is a good sign they’re being deployed to expand outpatient access. However, the system was struggling with inpatient throughput, and its APPs on the inpatient side were being treated as scribes, instead of as a vital part of the care team that would allow the team to see more patients.

Organizations that make the best use of their APPs are looking to find ways for APPs to work alongside physicians to improve access, as well as total volumes and revenues. Given the high cost of inefficient APP models, provider organizations should be looking at their investment per APP like they do their investment per physician. If your healthcare organization wants to explore ways to better utilize its APPs, please don’t hesitate to reach out.

On Our Podcast

Gist Healthcare Daily—all the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

In addition to the news discussed above, our Gist Healthcare Daily podcast covered many of the week’s other big stories, including U.S. News & World Report introduces ambulatory surgery center rankings, preliminary data shows drug overdose deaths in the US dropped in 2023, and a third major health system sues MultiPlan.

To stay up to date, be sure to tune in each weekday morning. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

We appreciate your readership. We’ll be back with more next week but, in the meantime, please visit our archive if you’d like to peruse past editions of the Gist Weekly.

Best regards,

The Gist Weekly team at Kaufman Hall