Welcome to another edition of the Gist Weekly. Please feel free to forward this edition to friends and colleagues, and encourage them to subscribe as well.

In the News

What happened in healthcare recently—and what we think about it.

- Community Health Systems plans to sell its three Pennsylvania hospitals. On Tuesday, Community Health Systems (CHS), a national, for-profit hospital operator based in Franklin, TN, announced a definitive agreement to sell its three hospitals in Pennsylvania, two located in Scranton and one in nearby Wilkes-Barre, to New Hope, PA-based Woodbridge Healthcare for $120M. Woodbridge is a recently established not-for-profit organization focused on hospital turnarounds. Should the deal receive regulatory approval, CHS would exit the Pennsylvania market and Woodbridge would convert the hospitals to not-for-profit status. Last year, CHS sold eight hospitals and divested its majority stake in another, and earlier this year, it reached a deal to sell a Tennova hospital in Tennessee, which is expected to close in the coming months. It also tried to sell two of its North Carolina-based hospitals to Novant, but that deal fell through in June after a Federal Trade Commission challenge.

- The Gist: This transaction exemplifies a recent trend in health system M&A: the focus of large national systems on strategic portfolio realignment. This trend is not limited to for-profit systems like CHS, Tenet, and HCA, as not-for-profit systems including Ascension and CommonSpirit Health have also been actively readjusting their hospital portfolios in recent months. It should also not be assumed that these large systems are strictly downsizing with these sales, as hospital divestures can free up capital to support potential new investments in other markets in which they may be better positioned.

- Bankruptcy judge allows Steward Health Care to close two Massachusetts hospitals. On Wednesday, US Bankruptcy Judge Christopher Lopez approved the closure of two of Dallas, TX-based Steward Health Care’s eight hospitals in Massachusetts by the end of August: Carney Hospital in the Dorchester area of Boston and Nashoba Valley Medical Center in Ayer. Judge Lopez justified his action due to the “incredible amount of loss on a weekly basis” that Steward is experiencing, and the fact that the system doesn’t have funding secured to keep its assets afloat for much longer. Steward—which has a portfolio of 31 hospitals across eight states and filed for Chapter 11 bankruptcy protections in early May—shared its intent to close the two Massachusetts hospitals, due to an absence of qualified bids, at a hearing last week. In response, MA Governor Maura Healey announced that the state has dedicated $30M to support operations at the two hospitals through the end of August in order to allow Steward more time to secure buyers for them. Steward has also struggled to secure qualified bidders for its hospitals in Ohio and Pennsylvania, as well as for its physician group, Stewardship Health. Optum backed out of purchasing the latter in June.

- The Gist: Steward’s bankruptcy proceedings have begun to shed more light on the system’s serious financial woes. Last week, the Senate Health, Education, Labor, and Pensions (HELP) committee joined a chorus of many, saying Steward executives mismanaged finances and that their actions have put patients at risk. HELP Committee members voted to both launch an investigation into the system’s bankruptcy as well as issue a subpoena to Steward CEO Ralph de la Torre to testify at a public hearing scheduled on September 12. In the meantime, patients in several states who rely on Steward’s services face losing a local option for hospital care.

- CMS approves North Carolina’s medical debt relief program. On Monday, the North Carolina Department of Health and Human Services announced it has received approval from the Centers for Medicare & Medicaid Services (CMS) for its plan to use the state’s Medicaid program to incentivize hospitals to relieve up to $4B of medical debt for about two million North Carolinians. Hospitals opting into the program must relieve all unpaid medical debt back to 2014 for Medicaid enrollees and all medical debt deemed uncollectible back to 2014 for state residents who are not enrolled in Medicaid but who meet certain income or total debt-to-income thresholds. Participating hospitals must also comply with other provisions around providing income-based discounts on medical bills, automatic patient enrollment into financial assistance, and limits to both selling medical debt and reporting debt to credit reporting agencies. In return, participating hospitals will share a pool of Medicaid funds estimated to total as much as $6.5B in FY2025, depending on how many hospitals opt into the program.

- The Gist: Unlike other recent initiatives by several local governments to relieve medical debt purchased from collection agencies, North Carolina is taking a unique approach in paying hospitals directly to forgive that debt and prevent it from going to collections in the first place. Especially given the fact that the Tar Heel state has the third-highest share of adults with medical debt, this program stands to be a “win-win” for both providers and patients. If it proves popular with providers, other states may look to follow North Carolina’s example.

Plus—what we’ve been reading.

- What the end of Chevron deference may mean for healthcare. Recently published in Health Affairs, this piece provides a thorough summary of how the end of “Chevron deference” could fundamentally alter healthcare policymaking. Chevron deference refers to a doctrine established by the Supreme Court forty years ago that allowed experts at federal agencies to reasonably interpret any statute which Congress left ambiguous. This “bedrock of regulatory action” was overturned by the Supreme Court last month in one of its most consequential decisions this term. The authors argue that “the shield of Chevron is now being replaced with a sword that can be wielded in new directions” and detail the varying levels of legal risk that some of the most contentious health policy issues of today now face.

- The Gist: The end of Chevron deference appears to be a harbinger of a new era in healthcare policymaking. It represents a dynamic shift in federal rulemaking that favors the judiciary and will likely make healthcare policymaking, which is already notoriously complex and agency-driven, far more difficult. The effect of this ruling on existing health policies will vary by program, but the net impact of Chevron’s overturning will likely be a less effective regulatory state subject to significantly more litigation.

Graphic of the Week

A key insight illustrated in infographic form.

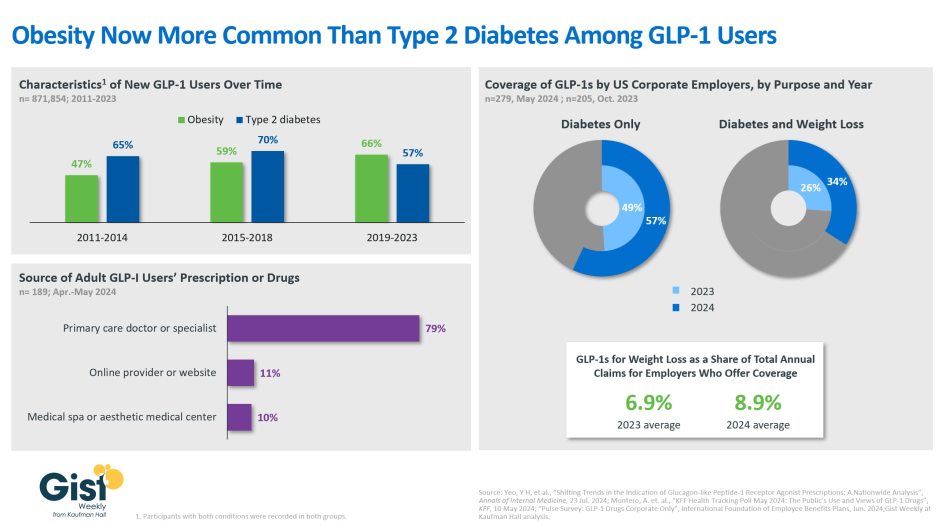

The evolution of GLP-1 drug usage

In this week’s graphic, we take stock of both the evolving usage and employer coverage of GLP-1 drugs, specifically for weight loss. Data from a new Annals of Internal Medicine study finds that more new US GLP-1 prescriptions were written for people with obesity than those with type 2 diabetes in recent years. Overall, the use of GLP-1 drugs among non-diabetic patients with either a BMI of 30-plus, or a BMI of 27 to 30 with an obesity-related co-morbidity, has doubled between 2011 and 2023. The persistent shortages brought on by these drugs’ expanding list of indications (semaglutide was approved for chronic weight management in 2021 and for cardiovascular risk in 2024; tirzepatide was approved for chronic weight management in 2023) is both exacerbating shortages for people with type 2 diabetes and driving many patients seeking them to non-traditional avenues. A recent KFF survey finds that more than a fifth of the 12% of US adults who report having ever used GLP-1s obtained their prescription or drugs from either an online provider or a medical spa, where the pitch is often focused on accessing expensive, difficult-to-find weight loss drugs for a fraction of their high prices. The drugs provided via these avenues are mostly compounded versions of GLP-1s, which are less regulated and may be unsafe. But employers’ willingness to cover name-brand GLP-1 drugs has also been increasing: a majority now cover them for diabetes only, and more than a third for both diabetes and weight loss. Employees and their beneficiaries with access to GLP-1 coverage for weight loss seem to be availing themselves of this benefit as employers offering it say that it represents an average of nearly 9% of their total annual claims. With more than a third of American adults considered to have obesity, and another third considered to be overweight, the demand for GLP-1 drugs for weight loss is only slated to increase.

On the Road

What we learned from our work in the real world. This week from Matt Robbins, Managing Director, at Kaufman Hall.

Exploring off-balance sheet financing options

The CFO of a medium-sized health system called me up recently to talk through financing options for an acquisition his organization is considering. “The Board has given us the green light to pursue growth, but they’re worried about our credit rating and are pushing us to fund some of our capital spend ‘off balance sheet.’ How are other systems tapping into alternative financing channels these days?”

Healthcare has always been a capital-intensive industry, but the current era of higher interest rates and a renewed emphasis on growth has shifted many of the conversations I have with health system executives from traditional debt financing toward alternative financing methods. Alternative sources of capital—including asset monetization, leasing, joint ventures, and partnerships—are options an organization can explore as it balances the need to make capital investments with the inevitable tradeoffs between cost of capital, control of the asset, and the impact to the organization’s credit. How each investment should be financed will of course also be particular to an organization’s specific strategic initiative, its current access to traditional capital, owned assets available for monetization, timeline, and tolerance for risk. If your healthcare organization is exploring financing options that don’t require taking on traditional debt or spending down cash reserves, I’m happy to share more of the innovative options I’m seeing in the market today—please don’t hesitate to reach out.

On Our Podcast

Gist Healthcare Daily—all the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

In addition to the news discussed above, our Gist Healthcare Daily podcast covered many of the week’s other big stories, including:

- FDA approves Guardant Health’s colorectal cancer blood test

- Walmart expands its specialty pharmacy business

- HHS renames ONC to oversee AI, cybersecurity, and health technology

Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

Thanks for reading! We’ll see you next Friday with a new edition. In the meantime, check out our Gist Weekly archive if you’d like to peruse past editions. We also have all of our recent “Graphics of the Week” available here.

Kind regards,

The Gist Weekly team at Kaufman Hall