Welcome to another edition, and thanks for your continued readership! We invite you to forward this edition to friends and colleagues, and encourage them to subscribe as well.

In the News

What happened in healthcare recently—and what we think about it.

- SCOTUS dismisses Idaho abortion law case, leaving the state’s emergency abortion ban paused. On Thursday, the US Supreme Court decided the case over an Idaho law prohibiting almost all abortions was “improvidently granted,” meaning a majority of the justices agreed that the Court should not review the case. This action reinstated the pause on the state’s emergency abortion ban that the Court had suspended while hearing the case earlier this year. After Idaho criminalized the provision of abortions with only very limited exceptions, one of which was “to prevent the death of the pregnant woman,” the Biden administration sued in 2022 on the grounds that aspects of the law conflicted with the Emergency Medical Treatment and Labor Act (EMTALA), a federal law requiring hospitals that receive federal funds to stabilize or transfer patients in need of emergency care. The administration argued that EMTALA requires abortions for pregnant people if needed to address health-threatening conditions, like organ failure or loss of fertility, not just death. In a short, unsigned opinion, the Justices dismissed the case without ruling on its merits, in part because Idaho amended its law since the suit began. The case will now return to lower courts for resolution, and Idaho providers can administer emergency abortions for the time being.

- The Gist: Providers were closely watching this case to see if it would resolve the issue of whether EMTALA supersedes state law in matters of protecting the health, in addition to the life, of patients, but the Supreme Court’s action has punted the matter back to lower courts. Although providers in Idaho are at least temporarily permitted to perform emergency abortions again, providers in other states with strict abortion bans, like Texas—whose law served as Idaho’s model—are still left in limbo. This action is the second, partial win for abortion rights to come from the Supreme Court this year, after the Justices dismissed a case to limit access to mifepristone, a commonly used drug in medication abortions, because the plaintiffs lacked standing.

- Appeals court mostly upholds ACA preventive services mandate. Last Friday, the Court of Appeals for the Fifth Circuit in New Orleans overturned a district court ruling that had nullified a requirement in the Affordable Care Act (ACA) that private insurers cover certain preventive care services without patient cost-sharing, although a nationwide injunction had kept the mandate in place while the case was appealed. In a decision that the judges themselves described as a “mixed bag,” the circuit court ruled that the US Preventive Services Task Force (USPSTF) lacked constitutional authority to issue legally binding recommendations, as its expert volunteer members are not nominated by the president and confirmed by the Senate. However, only the plaintiffs—two companies in Texas that argued covering contraceptives, HPV vaccinations, and HIV prevention medicines violated their religious beliefs—have been granted relief to disregard USPSTF recommendations, and all other companies must remain in compliance. The circuit court also declined to rule on the legality of ACA coverage recommendations for contraceptives and vaccines, which are issued by other advisory groups than the USPSTF, instead returning these matters to the original district court.

- The Gist: Although this decision leaves the door open for further rulings and legal challenges, providers and patients can celebrate that preventive care services remain free of cost-sharing, for now. The preventive care mandate is one of the ACA’s most popular provisions, and overturning it would be highly disruptive and harmful to patient health, especially given about half of US adults say it’s difficult to afford healthcare costs. This ruling also suggests that a permanent resolution to legal questions surrounding the USPSTF’s authority may require Congressional action.

- Cone Health to join Kaiser Permanente subsidiary Risant Health. Last Friday, Greensboro, NC-based Cone Health announced that it signed a definitive agreement to join Risant Health, Kaiser Permanente’s not-for-profit subsidiary. Launched in April 2023, Risant aims to acquire and support not-for-profit health systems focused on value-based care. If the deal is approved by regulators, Cone Health, a $2.8B not-for-profit system with five hospitals and an insurance arm, would join Danville, PA-based Geisinger as Risant’s second member. As part of the deal, Risant will invest an undisclosed sum into Cone, but Cone will continue to operate independently, retaining its branding, leadership, and ability to work with multiple insurers. The two parties expect to close the deal in the next six months.

- The Gist: Like Geisinger, Cone has a strong track record of value-based care, including a 15K-member health plan and a high-performing accountable care organization. Neither Risant nor Kaiser has operations in North Carolina, a state currently seeing strong population growth. Risant has previously said that is looking to acquire four or five more systems in addition to Geisinger, in order to reach a combined revenue target of $30-35B over the next five years.

Plus—what we’ve been reading.

- A new world of DIY medical tests. Recently published in the Washington Post, this piece details how some patients are turning away from traditional providers and towards a growing world of DIY medical tests in a “parallel medical ecosystem.” Fueled by significant investments from Silicon Valley, a blitz of social media marketing, and a rising mistrust in “Big Health,” the tests have become increasingly popular for health conditions that can be difficult to diagnosis, such as gut problems or hormone deficiencies. As “wellness” tests marketed directly to consumers are not supervised by the Food and Drug Administration (FDA), providers worry that recommendations from these tests may be misleading, if not harmful, to some patients’ health. The article’s authors illustrate how these tests can swing from enabling patients “to become the CEO of their own health” to sometimes providing counterproductive results to patients that can create “a vicious cycle of unnecessary testing, spending and anxiety.”

- The Gist: The home diagnostics market generates $6B annually and is slated to increase by nearly 70% by 2032. While the FDA is now starting to regulate laboratory medical tests, there are an increasing number of direct-to-consumer wellness tests that fall into a regulatory gap. Providers need to be ready to engage with patients about these non-traditional tests, working to understand what drove their patients to DIY testing. Their clinical expertise can also help patients interpret the results of these tests, including sharing important context and concerns when evaluating treatment options.

Graphic of the Week

A key insight illustrated in infographic form.

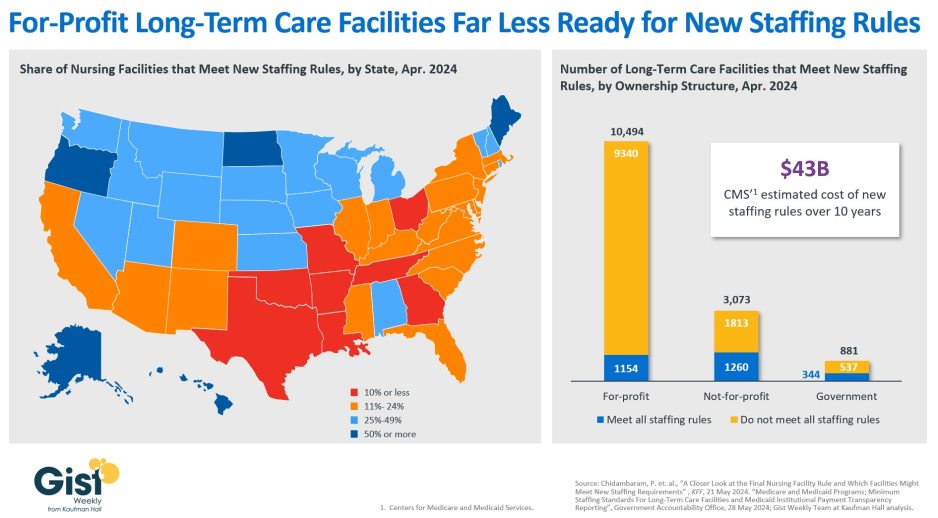

A closer look at nursing facility readiness for new staffing minimums

In late April, the Centers for Medicare & Medicaid Services (CMS) established new staffing standards for long-term care (LTC) facilities, mandating a minimum of 3.48 hours of nursing care per patient per day, with 33 minutes of that care from a registered nurse, at least one of whom must be always on site. The rule is slated to go into effect in two years for urban nursing homes and three years for rural nursing homes, with some facilities able to apply for hardship exemptions. Although about one in five LTC facilities nationwide currently meet these staffing standards, staffing levels vary greatly by both state and facility ownership profile. In 28 states, fewer than a quarter of LTC facilities meet the new standards, and in eight states fewer than 10% of facilities are already in compliance. Facilities in Texas are the least ready, with only 4% meeting the new staffing minimums. In terms of ownership structure, only 11% of for-profit facilities—which constitute nearly three quarters of all LTC facilities nationwide—have staffing levels that meet the new staffing minimums. The Government Accountability Office projects this new rule will cost LTC facilities $43B over the first ten years, a significant expense at a time when recruiting and retaining nursing talent is already challenging. Citing the risk of mass closures from facilities unable to comply, nursing home trade groups are suing to stop the mandate from going into effect, and there is also a bill advancing in the House that would repeal the staffing ratios. That bill is backed by the American Hospital Association, which fears the mandate “would have serious negative, unintended consequences, not only for nursing home patients and facilities, but the entire health continuum.”

On the Road

What we learned from our work in the real world. This week from Webster Macomber, Senior Vice President, at Kaufman Hall.

Creating partnerships with high-priority Medicare Advantage plans

A health system CEO recently reached out to me with a specific complaint that’s become a hot-button issue for an increasing number of systems: “Medicare Advantage (MA) is no longer a good payer for us. When you factor in all the pre-auths and denials, we’re now getting four points less yield from our MA patients than from our traditional Medicare patients. But our market is swinging hard toward MA, and I know the program’s not going anywhere…so how can we rethink our MA business model to make it more profitable?

After more than a decade of rapid growth, MA plans are now running into headwinds that are reducing their margins and creating an even more contentious negotiating environment with providers. However, these heightened competitive pressures could also be seen as an opportunity for provider organizations. Rather than treating all of their MA payers as a monolith, a health system or other larger provider organization should be reassessing its MA book of business with the goal of identifying priority MA payers with which to pursue deeper, mutually beneficial partnerships. The first step here is usually for a system to undergo a holistic tiering or ranking exercise for all of their MA payers according to factors like market share, contribution margin, value-based incentives, overall relationship dynamic, and projected market growth. This exercise will identify not only which MA payers may not be high-priority, long-term partners, but also which MA payers are suitable for developing deeper relationships with (e.g., simplifying administrative burden, better rewards for value-based care, creating a joint insurance product). If your system is facing challenges with MA and is interested in rethinking its MA portfolio strategy, please don’t hesitate to reach out.

On Our Podcast

Gist Healthcare Daily—all the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

In addition to the news discussed above, our Gist Healthcare Daily podcast covered many of the week’s other big stories, including:

- UAB Health System plans to acquire Birmingham, AL-based Ascension St. Vincent’s

- Supreme Court to hear challenge to Tennessee law banning transition care for minors

- US Surgeon General declares gun violence a public health crisis

A brief programming note: The podcast will be off next week, but please tune back in on Monday, July 8 for more new episodes. In the meantime, we encourage you to check out some of the in-depth interview episodes archived in our podcast library.

Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

The Gist Weekly will not be published next Friday due to the July 4th holiday, but we’ll be back with a new edition on Friday, July 12. Until then, please check out our archive if you’d like to peruse past editions.

Best regards,

The Gist Weekly team at Kaufman Hall