Welcome to another edition of the Gist Weekly. Please feel free to forward this edition to friends and colleagues, and encourage them to subscribe as well.

In the News

What happened in healthcare recently—and what we think about it.

- FDA advisory committee recommends approval of Eli Lilly’s Alzheimer’s drug. On Monday, a committee of independent advisors to the Food and Drug Administration (FDA) voted unanimously to recommend the agency’s approval of donanemab, Eli Lilly’s treatment to slow the progression of early Alzheimer’s disease. This recommendation follows the agency’s move to delay approval of the drug back in March, citing a need for more review of its safety and effectiveness. If the FDA follows this week’s committee recommendation as anticipated, donanemab would become the second Alzheimer’s treatment to receive full FDA approval, following Eisai and Biogen’s drug Leqembi. (Their other drug, Aduhelm, was granted accelerated approval but has since been discontinued.) Compared to Leqembi, donanemab showed greater efficacy at clearing amyloid plaques from the brain, which have been linked to Alzheimer’s disease, but was associated with greater risk of side effects like brain swelling and bleeding. FDA advisors concluded that donanemab’s benefit of lowing cognitive decline outweighed its risks, but they expressed concerns that certain patient subgroups were understudied or may be more likely to experience side effects. The FDA’s final decision is expected in the coming months.

- The Gist: Given that the number of Americans living with Alzheimer’s disease is projected to double by 2060, and only one approved treatment is currently on the market, the FDA committee sawdonanemab’s potential benefits as worth its risk of serious side effects. The Centers for Medicare and Medicaid Services (CMS) previously announced it will provide Medicare coverage for Alzheimer’s disease drugs that receive full FDA approval, if administered in “appropriate settings” by providers who participate in a registry that collects drug efficacy and safety data. Donanemab, like Leqembi, is administered via intravenous infusion, however the manufacturers of both drugs are currently testing forms new forms that can be given via skin injection.

- Biden administration proposes banning medical debt from credit reports. On Tuesday, the Consumer Financial Protection Bureau (CFPB) announced a proposed rule to eliminate all medical debt from consumer credit reporting, along with banning the repossession of medical devices. The White House press release for the rule stated that more than 15M Americans, with a total of $49B in medical debt, could see their credit scores improve by an average of 20 points due to this action. CFPB Director Rohit Chopra justified the policy by pointing to research showing that “medical bills on your credit report aren't even predictive of whether you'll repay another type of loan.” The rule, which has been in the works since September, could be finalized and go into effect as soon as early next year.

- The Gist: It’s estimated that more than four in ten adults in the US have debt due to medical or dental bills. Although this rule would not relieve their medical debt, it would help limit the downstream impact of that debt for many of them. In recent years, the three major credit reporting agencies have taken steps to remove certain medical debts, such as those under $500, from their reports. But given the pervasiveness of medical debt in this country, the burden rests on many different stakeholders in the broader healthcare system to ensure that less of this debt is generated in the first place.

- Elevance becomes the second insurer to (partially) win its MA star ratings lawsuit. A district court ruling last Friday found that the Centers for Medicare and Medicaid Services (CMS) needs to recalculate the Medicare Advantage (MA) star ratings for Elevance’s Blue Cross Blue Shield of Georgia plan, after the agency failed to follow proper administrative procedure when it changed the methodology for calculating the ratings. Elevance claimed its star rating drops cost it $500M in quality bonus payments. The judge narrowed his ruling to only one of several subsidiary health plans that Elevance sued on behalf of, saying that Elevance failed to prove its other subsidiaries were impacted by the methodology adjustment, but said that the insurer could file another suit on behalf of them “with the appropriate legal argument and evidentiary support.” SCAN Health Plan won a similar lawsuit against CMS last week, claiming that its star rating drop resulted in it losing $250M in quality bonuses. In response to these rulings, CMS announced late on Thursday that it will recalculate all 2024 MA quality ratings and adjust the results for plans that see their ratings increase.

- The Gist: CMS is responding to these rulings by proactively recalculating 2024 ratings, staving off further lawsuits and giving MA insurers a win at a time when fewer MA plans are receiving high star ratings and MA profitability is declining. But this poses complications for 2025 MA plan bids, which insurers now can now resubmit by June 28 to account for the revised ratings. Although the star rating system attempts to improve the quality of MA plans, it is controversial among some health policy experts who question its value given federal spending on MA bonus payments has increased every year since 2015, and rose by almost 30 percent between 2022 and 2023.

Plus—what we’ve been reading.

- Cancer disrupting more than patients’ physical health. Recently published in the Wall Street Journal, this piece details the financial impact of several people stricken by cancer diagnoses. The cost of treating the disease has skyrocketed in recent years as medications have become more targeted: one report found that 55 percent of cancer drugs brought to market between 2019 and 2023 came with a price tag of at least $200,000 annually. With cancer incidence also skewing younger, these diagnoses are hitting more people during their peak earning years and before they have more stable health insurance coverage through Medicare. Some cancer patients are even being forced to file for bankruptcy, which raises their cancer mortality risk by a startling 80 percent. The authors illustrate that “financial toxicity” has now become almost synonymous with a cancer diagnosis, leaving an increasing number of families in the tough position of having to sacrifice their financial wellbeing to care for themselves or a loved one.

- The Gist: Although Americans have access to preeminent cancer providers and medications, and cancer mortality in this country has been declining for decades, too many patients and their families are left in financial ruin by life-saving cancer treatments. Care options may also be limited by issues related to affordability, especially given the proliferation of high deductible health plans and other forms of patient cost-sharing. This piece makes clear the impacts of financial stress on health, underscoring how important it is for providers to approach cancer treatment holistically, with an eye for the lives patients continue to live after they survive.

Graphic of the Week

A key insight illustrated in infographic form.

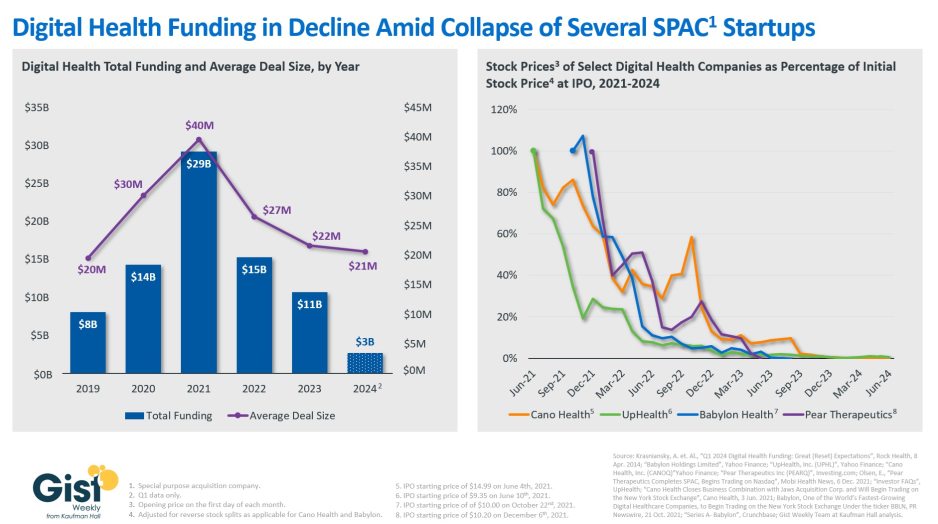

Digital health bankruptcies chilling the funding market

In this week’s graphic, we take stock of digital health funding and the fate of several digital health startups that went public during the funding boom of 2021. Digital health funding dropped to $10.7B in 2023, a 63 percent decline compared to 2021. Based on preliminary data from the first quarter of 2024, this year’s total is shaping up to be comparable to 2023 levels. The average deal size has also fallen to $21M, similar to pre-pandemic levels and only about half of its 2021 peak. Along with higher interest rates and a less bullish economy overall, the stock delistings and bankruptcies of several publicly traded digital health companies may also be impacting how investors consider the market. Several digital health startups that went public in 2021 via special purpose acquisition companies (SPACs), including Cano Health and Babylon Health, filed for bankruptcy only a few years later. Once touted as disruptors, these companies were unable to translate their initial capital infusions into sustainable operations. Already potentially overvalued by the economic environment at the time they went public, when they proved unable to return profits fast enough, investors lost faith, and the bubble burst. Given that most startups fail, and healthcare is particularly difficult to disrupt, the digital health market shouldn’t be written off entirely, but a reset in expectations (and valuations) is being established.

On the Road

What we learned from our work in the real world. This week from Chris Peltola, Senior Vice President, at Kaufman Hall.

Holistically assessing SNF relationships

Worried about the effects of the new nursing home staffing mandate, a health system CFO recently reached out to me to talk. “We’re thinking this is going to limit high-quality SNF options in our market and increase our length of stay. Even if all our local SNFs stay open, they might reduce their bed counts to make it easier to hit staffing ratios. What are the financial implications to our system from local SNF beds shutting down? And how should we proactively mitigate these challenges?”

When discussing relationships with skilled nursing facilities (SNFs), many health system leaders want to jump right to solutions—should we lease beds, joint venture, acquire, etc.—but this CFO was interested in better understanding the specific challenges and their associated financial impact, which is the right place to start. A holistic assessment of the value generated by strong, systemwide SNF relationships requires accounting for several financial dynamics: cost savings from more efficient inpatient and ED throughput, backfill volume opportunity and associated incremental revenue, reduced readmissions, and other benefits associated with SNF clinical quality and operating efficiency. Each hospital will have its own analysis of where its key discharge bottlenecks are, especially in terms of specific patient populations or service lines. This exercise sheds light on the true benefits against which the costs (both financial and time/effort) of a SNF relationship should be measured, which is essential because those costs can be significant. If your system is (re)evaluating its SNF relationships, I’m happy to share more about various partnership options as well as how to account for the full picture of costs and benefits—please reach out.

On Our Podcast

Gist Healthcare Daily—all the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

In addition to the news discussed above, our Gist Healthcare Daily podcast covered many of the week’s other big stories, including:

- The Supreme Court rejects challenge to FDA’s approval of mifepristone

- Ascension says personal data may have been compromised in recent cyberattack

- Kroger Health’s The Little Clinic will provide access to GLP-1 weight loss drugs

A brief programming note: The podcast will be off next week, but please tune back in on Monday, June 24 for more new episodes. In the meantime, we encourage you to check out some of the in-depth interview episodes archived in our podcast library.

Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

We look forward to you joining us again here next week! Until then, visit our archive if you’d like to peruse past editions of the Gist Weekly.

Best regards,

The Gist Weekly team at Kaufman Hall