Jason Sussman, Gaby Hawat, Larenda Mielke, and Erik Kahill

In our two most recent blogs, we have been exploring the importance of institutional financial literacy, looking first at financial literacy as a leadership prerequisite, and then at how college and university leaders can best promote the need to share and care about financial information. In this final blog in our financial literacy series, we look at how financial literacy supports the essential task of integrated strategic financial planning.

At many institutions, strategic planning and financial planning are separate functions. Strategic planning casts a wide net, with many individuals involved in developing strategic initiatives from the department to the institutional level. When the time comes to put numbers around those initiatives, however, far fewer individuals are involved, and decisions on which initiatives are funded or not funded are not always transparent.

The corridor of control

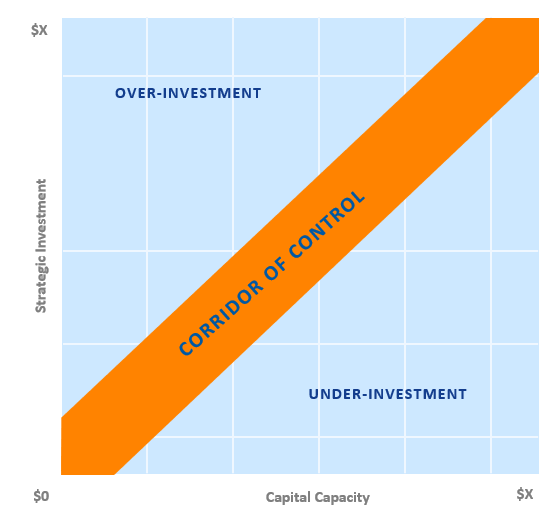

One of the primary reasons to promote financial literacy is to cultivate a common understanding of an institution’s financial health that provides context for leadership’s decisions. This is supported by the use of a common, understood language for discussing issues related to financial health. We have found that one of the most effective ways to cultivate this common understanding is through a simple graphic that we call the “corridor of control.” The corridor of control is a means of communicating the fundamental point that an institution’s strategic investments must align with its capital capacity to achieve a sustainable level of financial equilibrium.

If strategic investments outpace capital capacity, the institution is at risk of over-investing. This can, among other things, strain the institution’s financial resources, negatively impact its credit rating, and significantly restrict its financial flexibility. If capital capacity exceeds strategic investments, the institution is at risk of under-investing, which can erode its competitive position and also (for different reasons) negatively affect its credit rating.

Familiarizing faculty and staff with the corridor of control concept should be an essential part of any financial literacy effort. By establishing that the institution will, over a multi-year planning period, consistently align its strategic investments with its capital capacity, leadership will have a clear framework to demonstrate that it is spending appropriately on its strategic investments. If the institution has strayed into the range of over-investment, it has a pre-established and clear basis to communicate the message for the need to increase financial discipline to bring spending back in line with its capital capacity. And if the institution is consistently under-investing, the corridor of control framework will provide a clear signal to leadership that the institution is at risk of lagging behind and weakening its competitive position. Essentially, an under-investing institution is leaving available capital capacity on the table and underfunding potential strategic opportunities.

The corridor of control also conveys the essential message that strategy and finance are linked. This, in turn, helps everyone involved in strategic planning understand that strategic initiatives cannot be of a magnitude that will deplete financial resources. Conversely and ideally, identified, current strategic initiatives will increase capital capacity to support future investments and growth.

Integrating strategic and financial planning

Kaufman Hall has long believed that strategic planning and financial planning must be highly interrelated and interdependent disciplines. In part, this is because an institution’s financial health depends on the thoughtful identification and execution of strategic initiatives that will drive the institution’s strategic and financial performance into the future.

Institutional financial literacy creates the perfect environment and means of communication in which an integrated strategic financial planning process can thrive. In a financially literate institution, individuals understand that:

- Strategic investments cannot exceed the institution’s capital capacity.

- Strategic initiatives require funding.

- Strategic initiatives must be quantified to ensure that adequate resources are available to support them. Realistic business planning with data-based projections of estimated costs and revenues associated with the initiative are vital to quantifying investment requirements.

- Identification and prioritization of strategic initiatives must reflect an overall portfolio that balances investments that generate additional revenue with those that are revenue neutral or require a financial subsidy in order to build capital capacity.

As understanding of the relationship between strategy and finance permeates the institution, so too does an understanding of the need to connect numbers with strategic initiatives. As a result, faculty and staff understand which strategic proposals are more likely to implemented, and why, and leadership has a means to more directly explain strategic decisions, backed by an understanding of the financial impact that these decisions will have on the institution.

Financial literacy also supports one of the four best practices for integrated strategic financial planning that we have identified: clear communication and direction of the plan’s implementation. To succeed, an integrated strategic financial plan must be visible and comprehensible across the institution, and each individual must understand his or her part in maintaining the financial discipline that will keep the plan on track. Financial literacy ensures that these conditions for success can be met.

As we head into summer, we hope you all have the opportunity to refresh and recharge for the academic year ahead. Please reach out to any one of us for more information on how to build financial literacy and an integrated strategic financial planning process to support your institution’s long-term goals.