Hospitals and health systems nationwide felt the impacts of rapidly rising COVID-19 cases in November, continuing months of volatility brought on by the pandemic. Margins were down and volumes and revenues continued to fall across most metrics, while expenses remained high compared to 2019 levels and above budget. Inpatient volumes, however, were on the rise as COVID-related hospitalizations more than doubled in November.

The situation is expected to worsen in the months ahead as holiday gatherings and colder weather drive case counts up even further, with more activities moving indoors. Skyrocketing COVID-19 infections already are stretching hospitals’ capacity, and some states have resorted to opening field hospitals to accommodate surplus demand.

The median Kaufman Hall hospital Operating Margin Index* narrowed to -1.1% year-to-date (YTD) in November without federal CARES funding. With the funding, it was 2.5% YTD. The YTD median Operating EBITDA Margin was 7.2% without CARES and 7.6% with CARES, illustrating the attenuating effects of the federal aid nine months into the pandemic.

Margins were down year-over-year (YOY) and month-over-month. Not including CARES, Operating Margin fell 11.6% (1.1 percentage points) compared to November 2019, and 16.4% (1.7 percentage points) from October 2020. Operating EBITDA Margin was down 11% (1.3 percentage points) YOY and 11.5% (1.6 percentage points) month-over-month. With CARES, Operating Margin fell 8.3% (0.9 percentage point) YOY and Operating EBITDA Margin fell 7.5% (0.9 percentage point) YOY.

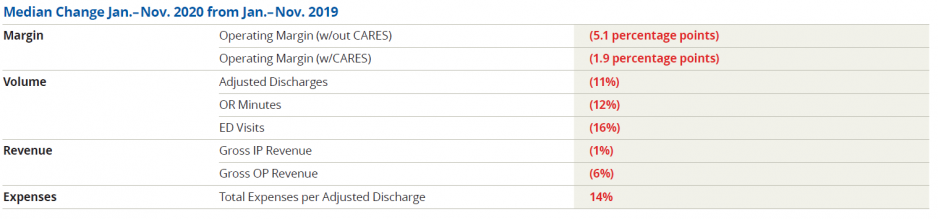

November’s downturn resulted in a 56.4% (5.1 percentage points) decline in Operating Margin for the period of January-November 2020 compared to the same period last year, and a 35.2% (5.0 percentage points) YTD decline in Operating EBITDA Margin without CARES. With CARES, Operating Margin fell 16.7% (1.9 percentage points) YTD and Operating EBITDA Margin fell 10% (1.7 percentage points) YTD.

The rising COVID-19 caseload drove unusual volume shifts in November compared with recent months. Inpatient volumes surpassed 2019 levels for the first time since the start of the pandemic, with Patient Days up 4.0% YOY. Discharges, however, remained down 5.1% YOY, resulting in across-the-board increases in Average Length of Stay at 8.7% YOY and 4.7% month-over-month. These increases indicate an uptick in higher acuity cases, including COVID-19 patients.

All other volume metrics were down for the month. As noted in previous issues, much of the volume downturns have been driven by changes in consumer behavior as people avoid or delay care due to concerns of exposure to the virus. Emergency Department Visits remain hardest hit, falling 15.5% YTD in November. Adjusted Discharges fell 11.1% YTD and Operating Room Minutes declined 12.2% YTD.

Revenue metrics were mixed for the month, aligning with volume metrics. Gross Operating Revenue (not including CARES) was up 4.2% YOY but down 3.8% YTD. Inpatient Revenue was up 12.7% YOY but down slightly 0.6% YTD, while Outpatient Revenue fell 0.6% YOY and 6.0% YTD. The shift away from outpatient services coupled with the inpatient increases led to a significant 6.0% YOY drop in the Inpatient/Outpatient (IP/OP) Adjustment Factor, driving it down 3.3% YTD. Bad Debt and Charity Care as a Percent of Gross Revenue was down 11.3% YOY and 4.2% YTD. Expenses continued to climb, as hospitals incur the high costs of caring for fewer but sicker patients. Total Expense per Adjusted Discharge remained well above 2019 levels, rising 14% YTD and 17.3% YOY. Labor Expense per Adjusted Discharge rose 15.2% YTD and 14.7% YOY, and Non-Labor Expense per Adjusted Discharge increased 14.2% YTD and 17.1% YOY.

Drug Expense per Adjusted Discharge increased dramatically in November, jumping 16% YTD and 28.9% YOY as hospitals continue to care for higher acuity and COVID-19 patients. Purchased Service Expense per Adjusted Discharge also was up significantly at 20% YTD and 24.9% YOY.

Looking at non-operating metrics, the equity markets responded positively to the election of Joe Biden and encouraging news in November surrounding COVID vaccine trials, with the Dow rising 11.84% and closing above the 30,000 mark for the first time in history. The Federal Reserve kept monetary policy steady at its November Federal Open Market Committee meeting, but highlighted concerns around COVID-19 and indicated that bond-buying programs may change in 2021. The strong second wave of the coronavirus has led many economists to downgrade fourth quarter GDP estimates for Europe and the Americas.

The November results reflect the mounting pressures for hospitals and provide a troubling sign of things to come if COVID-19 cases continue to rise over the winter months. Distribution of millions of doses of the newly approved COVID-19 vaccines started this month, but how quickly

they will influence case numbers remains to be seen. Hospital and health system leaders could face significant challenges in the coming months, with rising infections, capacity issues, and strained resources stressing facilities and healthcare workers more than at any point since the pandemic began. Now is the time to support our nation’s hospitals. We will continue to report as data becomes available.

* Note: The Kaufman Hall Hospital Operating Margin and Operating EBITDA Margin Indices are comprised of the national median of our dataset adjusted for allocations to hospitals from corporate, physician, and other entities.