by The Gist Weekly Team at Kaufman Hall

Welcome back to Gist Weekly, where we distill the latest healthcare news, trends, and our conversations with industry leaders into actionable guidance for CEOs and senior executives. We’re happy to have earned a place in your inbox, and welcome you to share this email with friends and colleagues—be sure to tell them to subscribe as well!

In the News

What happened in healthcare recently—and what we think about it.

- Corvallis Clinic plans to join Optum. Last week, the Corvallis Clinic, an independent physician-owned multispecialty group with over 100 providers based in Corvallis, Oregon, shared that it intends to join UnitedHealth Group’s Optum subsidiary. The clinic’s board of directors cited industry financial pressures, including a forecast of material losses for the next 12 months even following a 15 percent compensation reduction by its physician-owners, as a key driver behind the decision to join the nation’s largest employer of physicians. The transaction was made public in part due to a disclosure notice by the Oregon Health Authority which, following the passage of a 2021 state law, reviews business deals involving healthcare entities through its new Health Care Market Oversight program. If approved, this would be Optum’s fourth physician group purchase in the Beaver State. It currently provides administrative and management services for two groups based in Eugene and a small group in Portland.

- The Gist: Echoing recent news of Intermountain-owned Saltzer Health seeking a buyer or else facing closure, large multispecialty groups are finding it increasingly difficult to sustain profitable operations in this more challenging post-pandemic operating environment. Optum seems well positioned acquire some of these assets, which state regulators may find preferable to the loss of local provider access stemming from potential closure.

- Cano Health files for bankruptcy. On Sunday, Miami, FL-based Cano Health, a Medicare Advantage (MA)-focused primary care clinic operator, filed for bankruptcy protection to reorganize and convert around $1B of secured debt into new debt. The company, which went public in 2020 via a SPAC deal worth over $4B, has now been delisted from the New York Stock Exchange. After posting a $270M loss in Q2 of 2023, Cano began laying off employees, divesting assets, and seeking a buyer. As of Q3 2023, it managed the care of over 300K members, including nearly 200K in Medicare capitation arrangements, at its 126 medical centers.

- The Gist: Like Babylon Health before it, another “tech-enabled” member of the early-COVID healthcare SPAC wave is facing hard times. While the low interest rate-fueled trend of splashy public offerings was not limited to healthcare, several prominent primary care innovators and “insurtechs” from this wave have struggled, adding further evidence to the adages that healthcare is both hard and difficult to disrupt. Given that Cano sold its senior-focused clinics in Texas and Nevada to Humana’s CenterWell last fall, Cano may draw interest from other organizations looking to expand their MA footprints.

- HHS establishes telehealth flexibilities for opioid treatments. The Department of Health and Human Services (HHS) has finalized a rule to make permanent some pandemic-era policies that allow patients to receive telehealth prescriptions for certain opioid addiction treatments without an in-person visit. These flexibilities, temporarily introduced under the COVID public health emergency, were found to both improve access to and reduce stigma around treatments like buprenorphine and methadone. This rule is relatively narrow, limited to providers working in certified opioid addiction treatment programs, and separate from a pending Drug Enforcement Agency (DEA) rule on broader telehealth flexibilities for controlled substances, currently extended through the end of 2024.

- The Gist:The pandemic broadened the availability of telehealth prescriptions, including easing access to effective opioid addiction treatments. The DEA now faces a more difficult decision ahead, as relaxed telehealth rules allowed prescriptions for abusable ADHD medications to spike, backed by a glut of online mental health companies, some of which have been accused of putting profits over proper patient care. With our country still facing the effects of the opioid crisis, concerns about the overprescribing of controlled substances will surely weigh on regulators’ minds as they navigate how to oversee telehealth prescriptions for controlled substances.

- Plus—what we’ve been reading: How GoFundMe use demonstrates the problem of healthcare affordability. Published this week in The Atlantic, this piece chronicles the increase in Americans using crowdfunding sites like GoFundMe to cover—or at least attempt to cover—their catastrophic medical expenses. Envisioned as a tool to fund “ideas and dreams,” the GoFundMe platform saw a 25-fold increase in the number of campaigns dedicated to medical care from 2011 to 2020. Medical campaigns have garnered at least one third of all donations and raised $650M in contributions. The article’s accounts of life-saving care leading to bankrupting medical bills are heartbreaking and familiar, and despite some success stories, the average GoFundMe medical campaign falls well short of its target donation goal.

- The Gist: Although unfortunately not surprising, these crowdfunding stats reflect ournation’s healthcare affordability crisis. Online campaigns can alleviate real financial burdens for some people; however, they come at the costs of publicly exposing personal medical information, potentially offering false hope, and financially imposing on friends and family. The majority of personal bankruptcies are caused by medical expenses, and recent changes like removing some levels of medical debt from credit reports are only a small step toward reducing the personal financial effects of medical debt. Absent larger-scale healthcare payment and coverage reform, healthcare industry leaders continue to be challenged with finding ways to decouple the provision of essential medical care from the risk of financial ruin for patients.

Graphic of the Week

A key insight illustrated in infographic form.

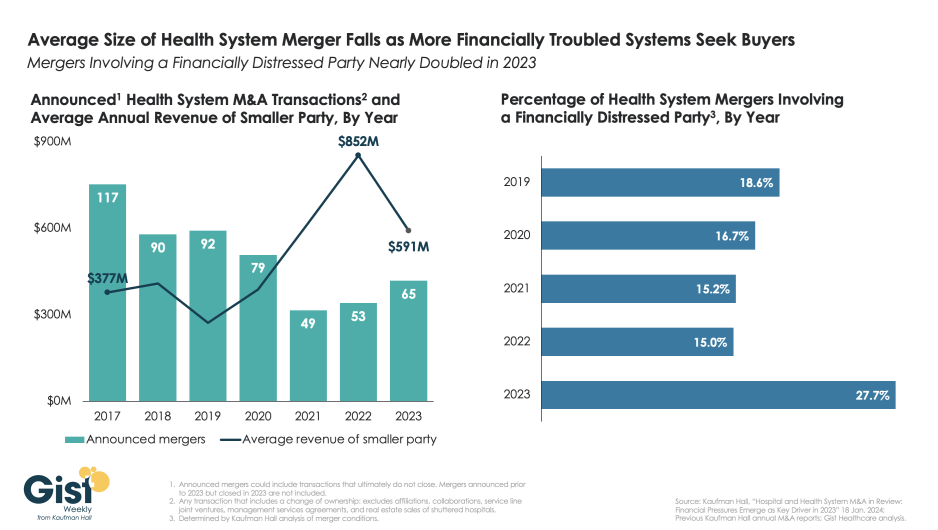

Financial distress increasingly prevalent in health system M&A deals

This week’s graphic highlights data from Kaufman Hall’s recently released 2023 Hospital and Health System M&A Report on the current dynamics in health system mergers and acquisitions (M&A) activity. After a slowdown during the pandemic, 2023 saw an uptick in M&A activity with 65 announced transactions, the most since 2020. Continuing the trend of the past two years, the number of announced “mega mergers,” in which the smaller party had at least $1B in annual revenue, represented more than a tenth of total announced transactions. However, the average size of mergers fell in 2023, as financial distress emerged as a key driver of M&A activity.The percent of mergers involving a financially distressed partyspiked to nearly 28 percent in 2023, almost double the level seen in prior years. CARES Act funding had buoyed some health systems’ balance sheets through the pandemic, but with the end of federal aid, more systems needed to seek shelter through scale. With the median hospital operating margin still barely hitting two percent, we anticipate this heightened level M&A activity to continue in 2024 as health systems search for stronger partners that can help them stabilize financially.

For more about hospital and health system M&A trends, listen to Gist Healthcare Daily’s recent interview with Anu Singh, Managing Director and Leader of Partnerships, Mergers, and Acquisitions Practice at Kaufman Hall.

On the Road

What we learned this week from our work in the real world.

Reframing the community benefit narrative

“Our industry can do a better job at telling our story around community benefit... most think of it as a math equation—property and sales tax exemption compared to charity care—but it’s much more than that,” a hospital CFO told us recently. It’s a sentiment likely shared by many not-for-profit health system leaders given headlines calling out hospital margins and reserves vis-à-vis their tax-exempt status.

“We can do an accounting exercise,” he went on to say, “but we need to creatively chronicle how we improve the lives or our patients, employees, and various stakeholders. We spend millions of dollars annually to maintain state-of-the-art facilities. Every day, not just during a pandemic, we provide services that go beyond our four walls. In many markets, we’re the largest employer in the community and attract other industries, an economic benefit that goes untold. We’re proud of everything we do to support our community and know it makes a difference in people’s lives. We need to communicate that healthy margins and reserves enable our ability to do so; deficit operations and a dwindling balance sheet do not. It’s time for us to reshape the narrative.”

We agree that not-for-profit health system leaders can do a better job shaping this narrative. It's increasingly clear that the messaging around community and economic benefit needs a refresh with a more succinct, meaningful, and compelling approach. At its very core, a well-run not-for-profit hospital is a community benefit, as a provider, employer, and solid community citizen. As hospitals are redeploying cash flow into capital, paying debt service, and building reserves for the next unexpected event, it’s an opportunity to reshape that story. How is your organization reframing this important narrative? The more we can all learn from one another, the more effective our messages will be. Reach out to Dan Clarin, Managing Director at Kaufman Hall, to discuss.

On Our Podcast

Gist Healthcare Daily—All the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

Last Monday, JC spoke with Anu Singh, Managing Director and Leader of the Partnerships, Mergers & Acquisitions Practice at Kaufman Hall, about how financial distress was a driving factor in many smaller-to-medium sized hospital and health system deals in 2023.

Coming up this Monday, we’ll hear the second half of their conversation about how more financially stable health systems are considering less traditional, more strategic partnerships, as well as what kinds of M&A conversations are happening right now in health system C-suites.

And be sure to tune in every weekday morning to stay abreast of the day’s biggest healthcare news. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

Another week in the books; thanks for reading! A brief programming note: we’ll be away at a company retreat next week, so won’t be publishing on February 16. Instead, our next edition should be out on Friday, February 23. In the meantime, don’t hesitate to reply to this email if there is anything we can do to be of assistance.

Best regards,

The Gist Weekly team at Kaufman Hall