Current Rate Environment

Fixed income markets have rallied based on improving funds flows following indicators suggesting the Fed is gaining ground in the battle against inflation. Corporate debt issuance is accelerating; not-for-profit healthcare issuance is behind last year’s early pace, but recent transactions for Advocate Health (put bond roll) and Orlando Health (fixed rate offering) garnered strong investor support and achieved favorable outcomes. Inflation and economic indicators remain unsettled, so anticipate volatility in response to any material divergence from the market’s dreams of a return to target zone inflation, no or a mild and short recession, and generally growth-accommodative interest rates.

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

Jan 27—UST |

4.68% |

3.62% |

3.52% |

3.64% |

|

v. Jan 13 |

-2 bps |

+1 bp |

+1 bp |

+2 bps |

|

Jan 27 – MMD* |

2.33% |

2.05% |

2.19% |

3.20% |

|

v. Jan 13 |

-10 bps |

-13 bps |

-12 bps |

-4 bps |

|

Jan 27 —MMD/UST |

49.79% |

56.63% |

62.22% |

87.91% |

|

v. Jan 13 |

-1.92% |

-3.76% |

-3.60% |

-1.59% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 1.66%, which is approximately 36% of 1-Month LIBOR and represents a -84 basis point adjustment versus the January 11, 2023, reset.

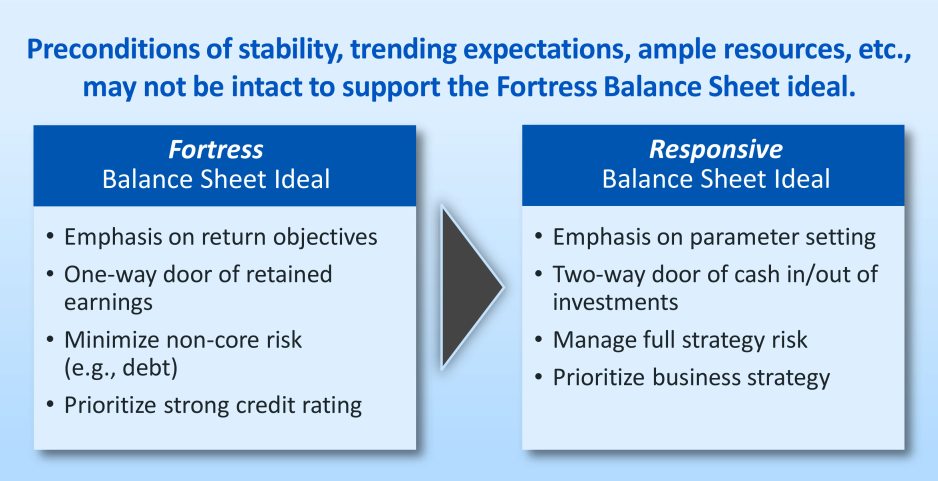

During the 2020 and 2021 manifestation of COVID, balance sheets emerged as the healthcare sector’s credit and resiliency anchor. During a period of unprecedented operating model dislocation, every credit market constituent took comfort from the inflating balance sheets that accompanied an equally unprecedented fiscal and monetary accommodation. 2022’s residual operating dislocation was paired with balance sheet deflation, and the tone of credit and capital positioning turned increasingly negative. Balance sheet strength supported the idea of “rating through the cycle” of pandemic dislocation; balance sheet weakness removed the buffer and shifted the sector onto a more negative trajectory. All of this confirms the idea that the balance sheet is the foundation of every not-for-profit healthcare organization; and one of the most important management considerations is how to position this pillar in relation to what is happening in operations. In this week’s email, my colleague Dave Ratliff and I collaborate on the “best” balance sheet for healthcare.

Fortress or Responsive Balance Sheet?

At the advent of the Peloponnesian war, the Athenian general and politician Pericles sought to use his nation’s relative advantages to avoid a land-based conflict with Sparta. Pericles’ strategy was to use the twin resources of accumulated wealth and a fortified city and port as a risk buffer that would allow Athens to manage the conflict on his terms and pursue a prolonged—but not eternal—status quo.

For healthcare, the notion of the fortress balance sheet has great appeal, especially during periods of sharp operating dislocation such as the COVID pandemic. Typically attributed to JP Morgan CEO Jamie Dimon, a fortress balance sheet suggests the equivalent of Athenian wealth—a buffer against crisis and perhaps even a chance to avoid it altogether. As noted above, not-for-profit healthcare credit and financial management generally tilts in this direction, placing immense importance on the balance sheet’s role in protecting the core and creating resiliency.

But healthcare organizations might be misreading what a fortress balance sheet should mean to their organization. The risk driver of the operating company that Mr. Dimon runs is tail risk, so his “fortress balance sheet” is one that defends against major credit and financial disruptors like recession or crisis. The risk landscape for every healthcare organization goes beyond balance sheet events and extends deep into the care delivery chassis and the daily battle for margin and cash flow. In this situation, different fortress balance sheet versions might prove to be unhelpful or even threatening.

The most tempting fortress balance sheet application assumes positioning resources to offset prevailing operating risk. In this construct, balance sheet serves as a risk buffer, such that investment portfolio risk and illiquidity are dialed back as risk elevates across operations and strategy. Under this application of a fortress balance sheet the question is whether we can forgo returns or tolerate the possibility that resources may not be positioned to participate in market recovery. A singular focus on balance sheet as a risk buffer might impair the ability of these resources to contribute to a responsive recalibration of risk-return relationships.

The other fortress balance sheet bookend might focus on filling the cash flow gap that accompanies operating dislocation. In this construct, the balance sheet stands as an isolated risk pool where resources are positioned to drive non-operating gains that offset operating losses. For this return-centric fortress balance sheet the questions might be: Can we live off dividends alone? Can we tolerate a singular, or even dominant focus on gains? The challenge is that an isolated focus on balance sheet returns disengages a critical relationship: at a time when we are experiencing elevated operating risk, is introducing elevated or isolated investment risk the best means of advancing mission?

What ultimately tested Pericles’ strategy? Ironically, a pandemic. When the Athenian countryside crammed into the already overpopulated city center, sickness spread and a plague wiped out a quarter of the population, including Pericles. This part of the Athenian lesson should be common to every risk manager: reliance on a single large-scale resource and strategy can create a level of concentration risk that causes the entire risk management infrastructure to collapse in upon itself. The question should always be whether resource management tactics stifle or enhance organizational agility, or the ability to respond to the multiplicity of rapidly shifting threats that have become the “new normal” for every healthcare management and board.

The best fortress balance sheet is one that is “responsive” to your organization’s need to balance and then rebalance the competing pressures of mitigating risk versus generating return. Pericles’s ultimate problem was concentration creep, which ultimately limited options in a moment of elevated risk. This suggests that the real work for healthcare leaders is developing a resource positioning framework that can be recalibrated over time in response to changes in the sources and severity of risk. What every stage in our own crisis—from pandemic lockdown to inflation to labor dislocation—reconfirms is that healthcare organizations are complex operating companies first, and the best balance sheet is one that can respond quickly and efficiently to shifting mission imperatives and operating pressures.